Section 4A-105: Other Definitions

Section 4A–105. (a) In this Article, unless the context otherwise requires, the following words and phrases shall have the following meanings:

(1) ''Authorized account'', a deposit account of a customer in a bank designated by such customer as a source of payment of payment orders issued by such customer to the bank. If a customer does not so designate an account, any account of such customer is an authorized account if payment of a payment order from that account is not inconsistent with a restriction on the use of such account.

(2) ''Bank'', a person engaged in the business of banking and shall include a savings bank, savings and loan association, credit union, or trust company. A branch or separate office of a bank is a separate bank for purposes of this Article.

(3) ''Customer'', a person, including a bank, having an account with a bank or from whom a bank has agreed to receive payment orders.

(4) ''Funds transfer business day'', the part of a day during which a receiving bank is open for the receipt, processing, and transmittal of payment orders and cancellations and amendments of payment orders.

(5) ''Funds transfer system'', a wire transfer network, automated clearing house, or other communication system of a clearing house or other association of banks through which a payment order of a bank may be transmitted to the bank to which the order is addressed.

(6) ''Good faith'', honesty in fact and the observance of reasonable commercial standards of fair dealing.

(7) ''Prove'', with respect to a fact means to meet the ''burden of establishing'' a fact as provided in paragraph (8) of subsection (b) of section 1–201.

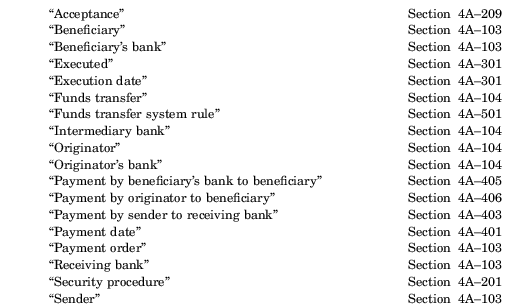

(b) Other definitions applying to this Article and the sections in which they appear are:

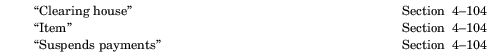

(c) The following definitions in Article 4 shall apply to this Article:

(d) In addition, Article 1 contains general definitions and principles of construction and interpretation applicable throughout this Article.