- Home

-

Report Sections

- Active Military and Veterans

- Animal Welfare

- Appropriations and Funding

- Children, Families & Persons with Disabilities

- Climate Change and Environmental Protection

- Consumer Protection

- Cradle to Career Public Education

- Economic Development, Job Creation and Workers Rights

- Equity, Access to Justice and Civil Rights

- Housing

- Mental Health, Public Health and Health Care

- Public Safety

- Tax Relief

- Transportation

Tax Relief

Status

Signed into Law

An Act to improve the Commonwealth’s competitiveness, affordability, and equity

This bill was signed into law by Governor Healey on October 4, 2023

Highlights

-

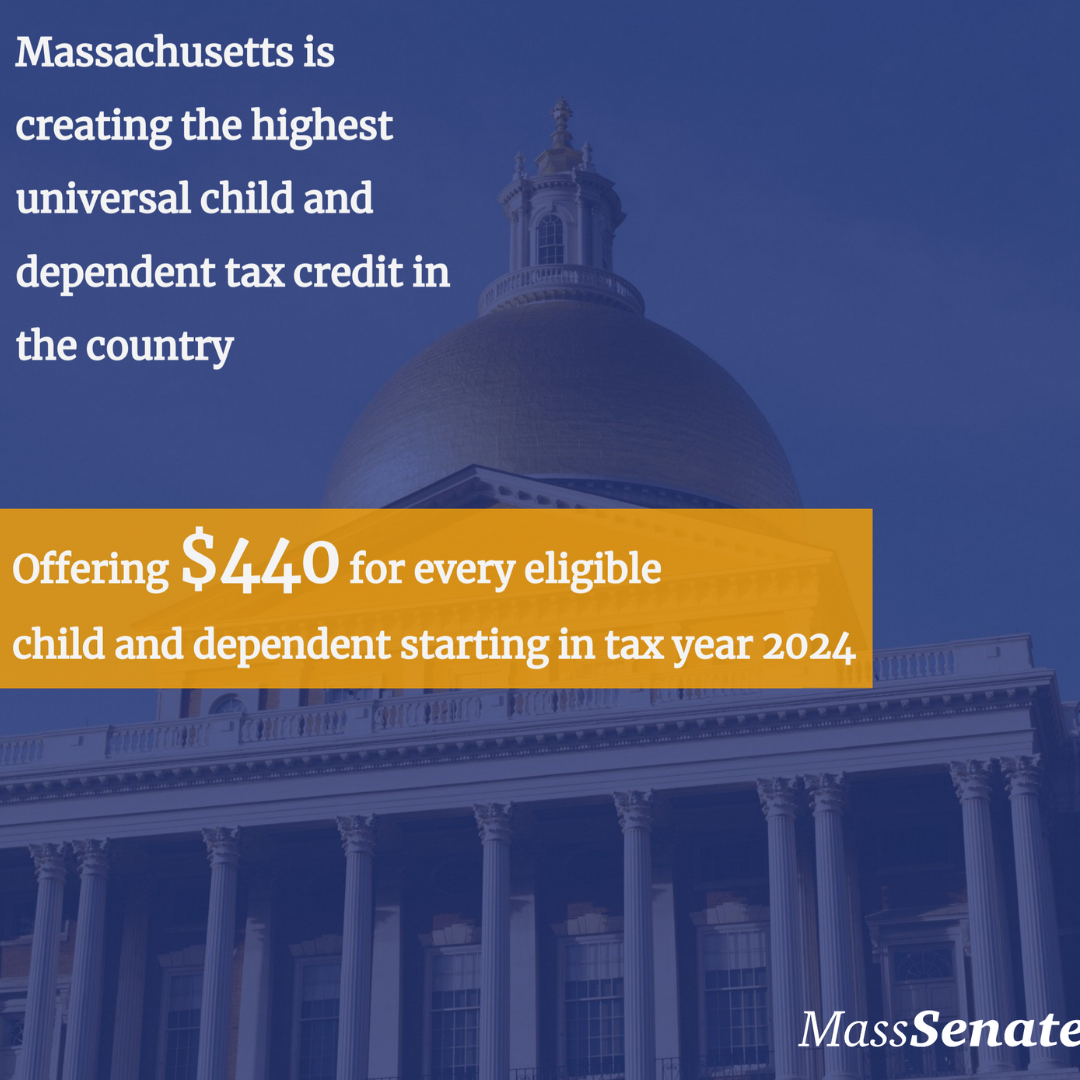

Child and Family Tax Credit

- Provides the most generous universal child and dependent tax credit in the country.

- Eliminates teh cap of two dependents and increases credit to $440 per dependent.

- Benefits an estiamted 565,000 families

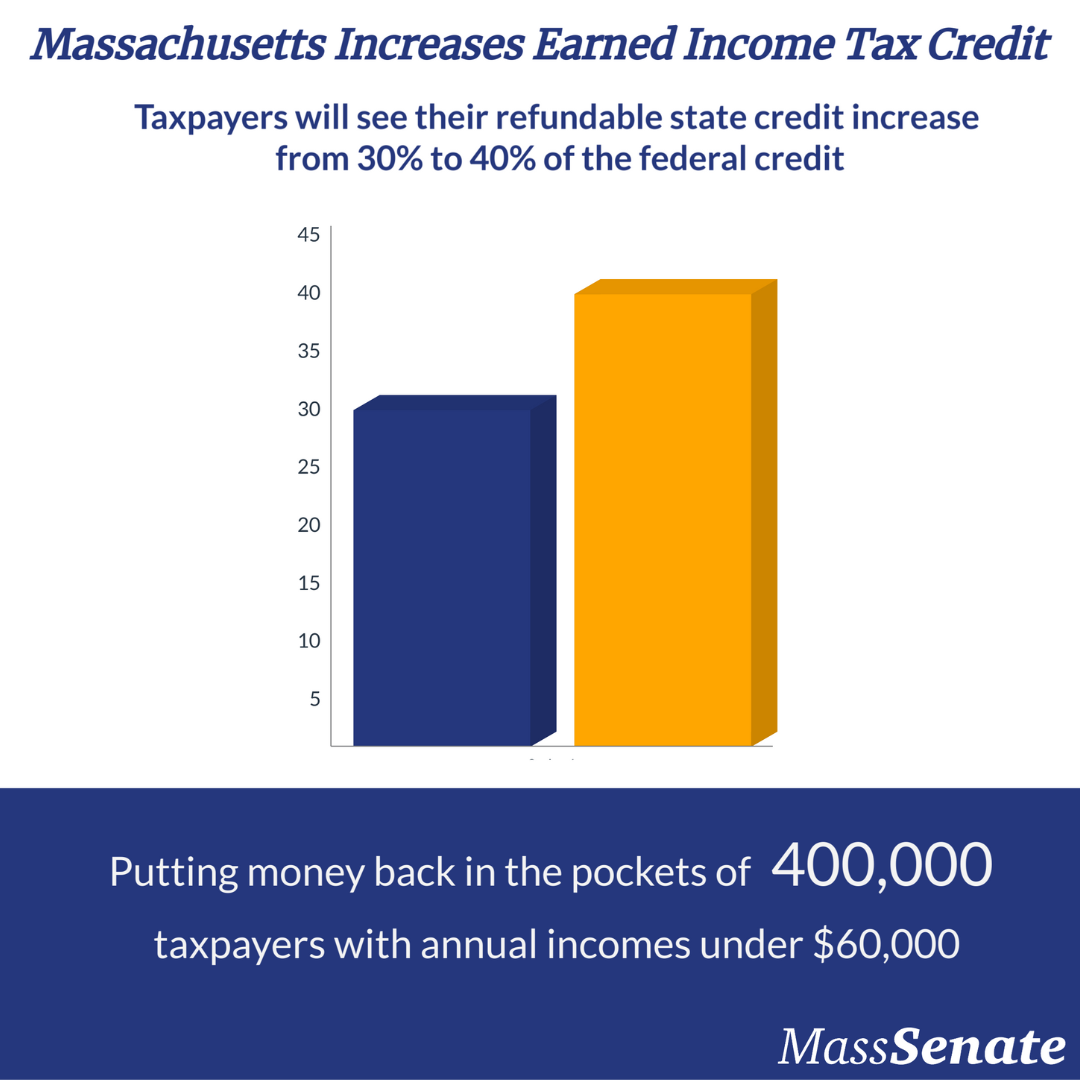

- Earned Income Tax Credit (EITC): Increased from 30% to 40% of the federal credit to provide critical support to working families

-

Support for Housing and Renters

- Increased statewide cap for the Housing Development Incentive Program (HDIP) from $10 million to $57 million on a onetime basis and then to $30 million annually to spur housing production.

- Increased the cap on the rental deduction from $3,000 to $4,000.

- Increased the Low Income Housing Tax Credit (LIHTC) annual program cap from $40 million to $60 million.

- Seniors: Doubles the maximum senior circuit breaker credit, which supports older residents struggling with high housing costs, from $1,200 to $2,400.

- Students: Exempts employer assistance for student loan repayment from taxable income.

-

Agricultural Support

- Increases the statewide cap for the dairy tax credit from $6 to $8 million

- Expands the types of alcoholic drinks which qualify for a lower tax rate to help Massachusetts cider producers.